How to Downsize for Retirement

If you’re approaching retirement age, you may be starting to notice that your house feels a little large. Any kids’ rooms are now empty or have been repurposed, and your six-person dining table is rarely being put to full use. Now that you use only a portion of the space you own, you’re likely paying for more house than you need.

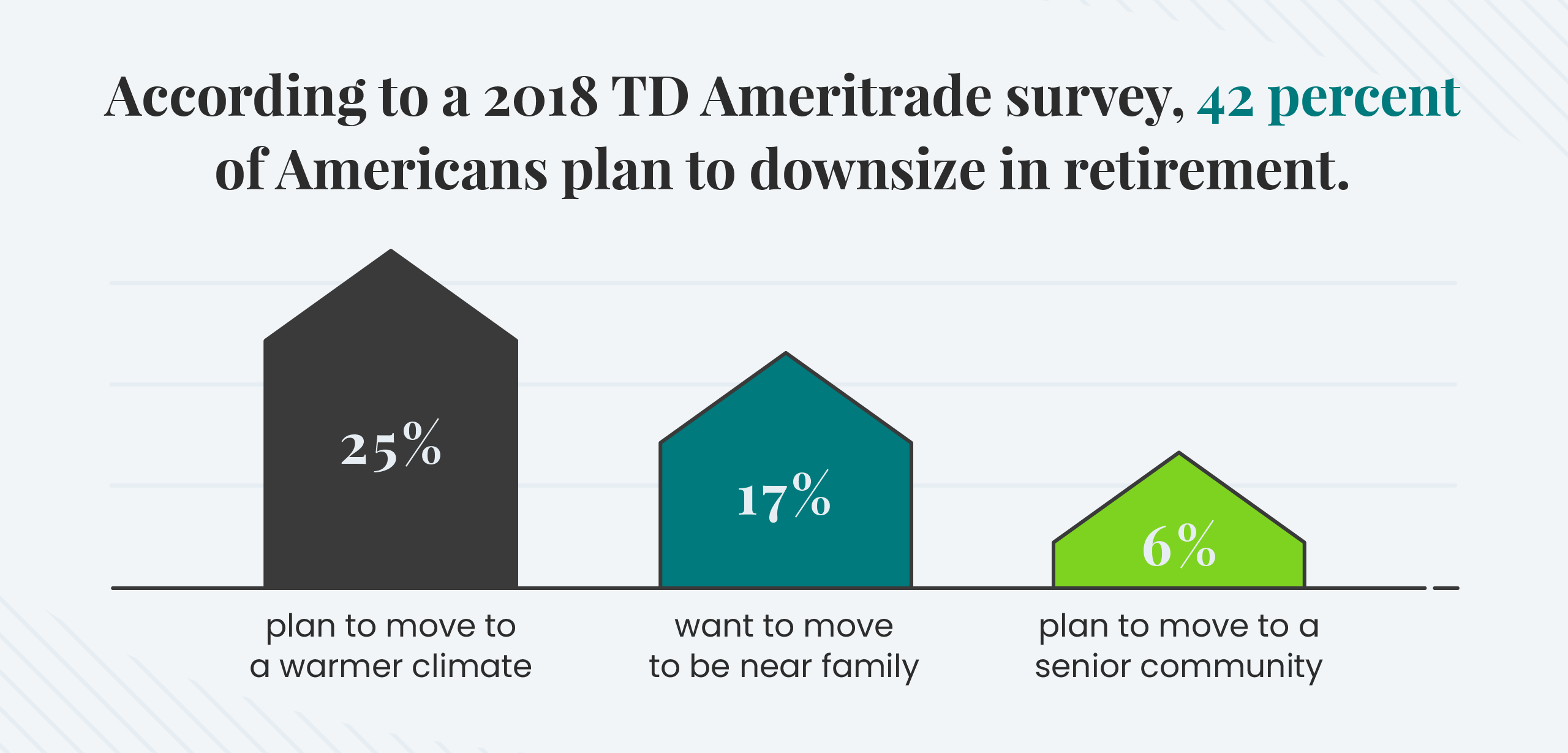

Downsizing your home is a smart move — and a common one. According to a 2018 TD Ameritrade survey, 42 percent of Americans plan to downsize in retirement. It’s not hard to see why; downsizing allows retirees to lower their monthly housing costs, move to a warmer climate or get closer to family and friends.

Once you decide to make the leap to a downsized location, you’ll want to get started right away. Like any move, downsizing can be complicated, so the more you can plan ahead, the easier the process will be. We put together a comprehensive guide to downsizing designed to carry you from the planning stages all the way over the threshold of your new home with the least stress possible.

What Do You Want?

Downsizing is about more than just an opportunity to save on your monthly housing expenses. It’s also an opportunity to find a living situation that’s completely different from your current one.

Decide whether you want to:

- Stay close to home or try somewhere new

- Move closer to family or friends

- Live in a house, condo, apartment or group living community

- Have greater access to a hobby (like hiking, skiing, boating, etc.)

You’ll also want to consider what you’ll be willing and able to maintain for the next few decades. Mowing the lawn or vacuuming a pool might not seem like much now, but you’ll likely feel differently in 20 years!

What Can You Afford?

Once you know what you want, you’ll need to figure out what’s realistic. Start by calculating what your monthly expenses will be in retirement. From there, you can determine how much you can afford to spend on a mortgage each month.

You’ll also need to know if you’ve reached your ideal retirement savings goals. If not, you may want to dedicate some portion of your home sale profits to bolstering your retirement fund rather than to the down payment on your new home.

Start Sizing Down

Believe it or not, prepping to move should come before buying your new home or even selling your current one. Downsizing takes much more time and energy than a standard move because it involves eliminating so much stuff. According to professional organizer Regina Lark, the average home has over 300,000 things, so you should start gradually eliminating items as early as a few years before you plan to move.

Here are a few strong strategies for downsizing your belongings ahead of your move.

Be Ruthless

Keep in mind that you’re not just moving; you’re minimizing. Adopt a strict attitude for evaluating what you’re really going to need in your new home. The more you eliminate now, the easier your move will be later.

However, don’t strip your house too much before it’s sold. You’ll want to stage your rooms to look appealing and homey during open houses, so it’s wise to keep a minimalist set of decorations so you don’t have to hire a staging service later on.

Digitize Your Media

Of course, you’ll want to hang onto treasured family memories. Thanks to technology, many of those memories can be uploaded to the cloud, where they won’t take up any physical space at all. Photos and even childhood artwork can be scanned and uploaded to a cloud storage platform like Dropbox or loaded onto a hard drive. Similarly, VHS tapes can be converted to DVDs or mp4s, and cassette tapes can be transferred to CDs or mp3s.

If you have too much content to digitize yourself, there are services that specialize in uploading photos, videos and tape recordings to the cloud for a fee.

Sell What You Can

Be realistic about what furniture and appliances you’ll really need in your new home. Do you need a full couch, or could you make do with a loveseat? Do you really drink a full pot of coffee, or would a French press be more economical?

You may be surprised how many of your belongings can be sold for a reasonable profit. If you want to stay local, you can list your items on Craigslist, Nextdoor or Facebook Marketplace and drop off whatever you sell. It’s easy to set up contactless, digital payments as well so you don’t have to bother with cash.

You can also access a wider pool of customers by selling online. Amazon seller accounts are free up to the first 40 items sold per month, with a 99-cent fee per sale as well as a nominal selling fee that varies according to category. Similarly, eBay offers free seller accounts (aside from a similar selling fee) up to 50 items per month.

Finally, there’s no going wrong with a good old-fashioned garage sale!

Donate the Rest

Once you’ve sold what you can, consider donating what you couldn’t sell. Goodwill and the Salvation Army are great options for general donations, or you can find more specific charities for particular items.

- Furniture and household goods: Aside from the standard charities listed above, Habitat for Humanity maintains "Restores" across the country where they accept, refurbish and sell household furniture to benefit the charity’s mission.

- Books, CDs and DVDs: Check your local library — many accept gently used media to be added to their collection.

- Professional clothing: Dress for Success is an organization that collects professional clothing and tools to help low-income women succeed in the workplace.

- Baby items: If you have any leftover baby toys or supplies laying around, consider donating them to Baby2Baby, an organization that supplies baby gear to shelters, hospitals and others in need.

- Old or broken electronics: Goodwill partners with Dell to collect electronic devices to be refurbished and donated to communities in need.

Prepare Emotionally

It’s totally normal to struggle with the emotional component of letting go of your home.

Here are a few tips to ease the process:

- Write your reasons for moving. As you decide why you’re downsizing, write it down. A study published in January 2018 by Cambridge University Press found journaling is therapeutic and helps us grasp the finality of a situation.

- Be prepared for bad news. If you receive a low offer or overhear a potential buyer’s comment on your lighting fixtures, it’s important that you not take these things to heart.

- Treat it like a breakup. Engage the same coping skills you would use when ending a relationship — vent with friends, exercise through the pain, dig into your comfort food of choice, etc.

- Manage your stress. Selling a home is a stressful process no matter how you feel about the house. Proactively employ stress management techniques like yoga or meditation to ease the pressure.

Eliminate Clutter

This step is precisely why it’s wise to start offloading nonessentials early. Before you can show your home to potential buyers, you’ll need to clean and organize everything. You want your house to look welcoming and cozy, not messy or chaotic.

Stash Personalized Items

By the same token, you should place personal items like trophies, family pictures and certificates out of sight. It’s important for potential buyers to be able to envision themselves living in your house, so anything that makes it look like it’s still your home should be tucked away.

Check Your Appliances

Any savvy homebuyer will check things such as light fixtures, sinks and shower faucets — even stove burners — so it’s essential that everything in your house is functioning properly. Check everything and fix whatever’s necessary. If you own something that’s functional but a little “off,” such as a sticky pilot light or flickering light, consider bringing in a professional to make it like new.

Consider Making Upgrades

As you’re checking your appliances, try to view them through a homebuyer’s eyes. Is your shower faucet an eyesore? Are you still working with countertops from the ’90s? Consider upgrading any elements of your home that don’t impress.

Beautify the Exterior

It’s called curb appeal for a reason. The impression your home gives at first glance will weigh heavily on the outcome of your sale. Basic maintenance such as lawn care and weeding is a must, but you should also consider extras like a fresh coat of paint on the exterior or a new flower bed to really sell the domestic image.

Hire a Realtor

Unless you’re a real estate agent yourself, you should absolutely hire a realtor to sell your home. Resist the temptation to DIY to save on fees. You may avoid giving a realtor a cut, but you’ll likely net a lower price without professional help. In fact, you should meet with multiple realtors before settling on one to make sure you’re choosing someone certified, competent and trustworthy.

Choosing a New Home

Realizing you can choose anywhere in the world to live can be overwhelming. Here are a few great options depending on your priorities.

Lowest Cost of Living

Maximize the financial savings of your downsize by choosing a low-cost location for your move. According to the Census Bureau’s 2018 American Community Survey five-year trends, the states with the lowest home costs are Mississippi at $114,500, West Virginia at $115,000 and Arkansas at $123,300.

Affordable Beach Towns

Those in search of an affordable beach option should consider Florida — specifically Merritt Island, Satellite Beach or Bonita Springs. You can also find affordable lake towns in Cornelius, North Carolina; Lake Havasu City, Arizona; and Folsom, California.

Affordable Mountain Towns

Cost-conscious mountain-lovers have a variety of moving options. One Kiplinger analysis concluded that retirees should consider Fayetteville, Arkansas, where cost of living for retirees is almost 14 percent below the national average, or Knoxville, Tennessee, where cost of living for retirees is 17 percent below the national average.

Best Locations for Expat Retirees

Adventurous retirees can often benefit from advantageous exchange rates by moving abroad. Business Insider places Portugal, Panama, Costa Rica, Mexico and Colombia at the top of its list of ideal destinations for retirees. Not only are many of these locations more affordable than many U.S. cities, but retirees can also take advantage of health care systems that are popular features of the thriving medical tourism industry.

Consider Moving in with Family

Undeniably the cheapest downsizing option would be to move in with family members who have extra space. If you have a good relationship with your family, moving in can be a feasible (and fun!) retirement option.

However, you should still take steps to ensure it’s a success:

- Avoid surprises at all costs. The first your family hears of your intentions shouldn’t be when you arrive at their door, suitcase in hand.

- Discuss expectations. Especially if you’re moving in with adult children, it’s important to talk up front about your new roles in the home to avoid conflicts later.

- Offer to pay rent. Despite being a cost-cutting strategy, moving in with family still isn’t free. Discuss a monthly contribution that feels fair.

- Divide labor. Even if you’re paying rent, you should still anticipate helping around the house. If there are grandkids in the picture, childcare is a great way to contribute.

If your family has a reasonably large property, you could also consider a “granny pod,” a modified tiny home designed to allow older parents to live with family while also maintaining strong boundaries and a sense of independence.

According to research by The Week, fully outfitted granny pods cost about $125,000 with installation. However, Chris Dorsey, owner of the company that produces the television show “Tiny House, Big Living,” says the average cost of a standard tiny home is between $30,000 and $40,000. If you don’t need any additional accommodations like chair lifts or safety equipment, these can be a very affordable option.

Downsizing without Moving

You may take a good hard look at the financials and realize that moving doesn’t make sense for you. Or perhaps you already live in the perfect location, and you don’t want to give it up. No matter the reason, plenty of people choose to retire in place, and that doesn’t mean you can’t still downsize and streamline your life.

Repurpose Old Rooms

You deserve a fresh start heading into retirement, which means cleaning out old unused bedrooms and reimagining them as part of your ideal home. What would you do with extra rooms if you were just moving in? With a little determination, you can have the music studio, den, exercise room, painting nook or other rooms you’ve always dreamed of.

Consider Renting

If you have extra space in your home, consider renting it out to make additional income. If you live in a split-level or otherwise have a living space with some privacy from the main home, a few renovations can turn it into an in-law apartment perfect for renters. You may not be able to cut down on costs by moving, but you can use your house to generate extra income instead.

Set Decluttering Deadlines

Without the hard deadline of a move, it can be difficult to follow through on downsizing your belongings — especially if you’re waiting for family members to come pick up items of their own. Be firm, both with yourself and with others. Call up your family and let them know their items are going to Goodwill after a certain date.

Whether you’re trading a huge house for a beach bungalow, planning a retirement overseas or planning to simplify at home, downsizing can be an awesome opportunity to rejuvenate your life as you head into your next chapter.

Please seek the advice of a qualified professional before making financial decisions.

Article Via Annuity.com. Image Via Pinterest.

Selling Your Home?

Get your home's value - our custom reports include accurate and up to date information.

.png)